Six Months to Go Until The Largest Tax Hikes in History

4 posters

Page 1 of 2 • 1, 2

Six Months to Go Until The Largest Tax Hikes in History

Six Months to Go Until The Largest Tax Hikes in History

Six Months to Go Until The Largest Tax Hikes in History

Ryan Ellis

July 7, 2010

In just six months, the largest tax hikes in the history of America will take effect. They will hit families and small businesses in three great waves on January 1, 2011:

First Wave: Expiration of 2001 and 2003 Tax Relief

In 2001 and 2003, the GOP Congress enacted several tax cuts for investors, small business owners, and families. These will all expire on January 1, 2011:

Personal income tax rates will rise. The top income tax rate will rise from 35 to 39.6 percent (this is also the rate at which two-thirds of small business profits are taxed). The lowest rate will rise from 10 to 15 percent. All the rates in between will also rise. Itemized deductions and personal exemptions will again phase out, which has the same mathematical effect as higher marginal tax rates. The full list of marginal rate hikes is below:

- The 10% bracket rises to an expanded 15%

- The 25% bracket rises to 28%

- The 28% bracket rises to 31%

- The 33% bracket rises to 36%

- The 35% bracket rises to 39.6%

Higher taxes on marriage and family. The “marriage penalty” (narrower tax brackets for married couples) will return from the first dollar of income. The child tax credit will be cut in half from $1000 to $500 per child. The standard deduction will no longer be doubled for married couples relative to the single level. The dependent care and adoption tax credits will be cut.

The return of the Death Tax. This year, there is no death tax. For those dying on or after January 1 2011, there is a 55 percent top death tax rate on estates over $1 million. A person leaving behind two homes and a retirement account could easily pass along a death tax bill to their loved ones.

Higher tax rates on savers and investors. The capital gains tax will rise from 15 percent this year to 20 percent in 2011. The dividends tax will rise from 15 percent this year to 39.6 percent in 2011. These rates will rise another 3.8 percent in 2013.

Second Wave: Obamacare

There are over twenty new or higher taxes in Obamacare. Several will first go into effect on January 1, 2011. They include:

The Tanning Tax. This went into effect on July 1st of this year. It imposes a new, 10% excise tax on getting a tan at a tanning salon. There is no exemption for tanners making less than $250,000 per year.

The “Medicine Cabinet Tax” Thanks to Obamacare, Americans will no longer be able to use health savings account (HSA), flexible spending account (FSA), or health reimbursement (HRA) pre-tax dollars to purchase non-prescription, over-the-counter medicines (except insulin).

The HSA Withdrawal Tax Hike. This provision of Obamacare increases the additional tax on non-medical early withdrawals from an HSA from 10 to 20 percent, disadvantaging them relative to IRAs and other tax-advantaged accounts, which remain at 10 percent.

Brand Name Drug Tax. Starting next year, there will be a multi-billion dollar tax assessment imposed on name-brand drug manufacturers. This tax, like all excise taxes, will raise the price of medicine, hurting everyone.

Economic Substance Doctrine. The IRS is now empowered to disallow perfectly-legal tax deductions and maneuvers merely because it judges that the deduction or action lacks “economic substance.” This is obviously an arbitrary empowerment of IRS agents.

Employer Reporting of Health Insurance Costs on a W-2. This will start for W-2s in the 2011 tax year. While not a tax increase in itself, it makes it very easy for Congress to tax employer-provided healthcare benefits later.

Third Wave: The Alternative Minimum Tax and Employer Tax Hikes

When Americans prepare to file their tax returns in January of 2011, they’ll be in for a nasty surprise—the AMT won’t be held harmless, and many tax relief provisions will have expired. These major items include:

The AMT will ensnare over 28 million families, up from 4 million last year. According to the left-leaning Tax Policy Center, Congress’ failure to index the AMT will lead to an explosion of AMT taxpaying families—rising from 4 million last year to 28.5 million. These families will have to calculate their tax burdens twice, and pay taxes at the higher level. The AMT was created in 1969 to ensnare a handful of taxpayers.

Small business expensing will be slashed and 50% expensing will disappear. Small businesses can normally expense (rather than slowly-deduct, or “depreciate”) equipment purchases up to $250,000. This will be cut all the way down to $25,000. Larger businesses can expense half of their purchases of equipment. In January of 2011, all of it will have to be “depreciated.”

Taxes will be raised on all types of businesses. There are literally scores of tax hikes on business that will take place. The biggest is the loss of the “research and experimentation tax credit,” but there are many, many others. Combining high marginal tax rates with the loss of this tax relief will cost jobs.

Tax Benefits for Education and Teaching Reduced. The deduction for tuition and fees will not be available. Tax credits for education will be limited. Teachers will no longer be able to deduct classroom expenses. Coverdell Education Savings Accounts will be cut. Employer-provided educational assistance is curtailed. The student loan interest deduction will be disallowed for hundreds of thousands of families.

Charitable Contributions from IRAs no longer allowed. Under current law, a retired person with an IRA can contribute up to $100,000 per year directly to a charity from their IRA. This contribution also counts toward an annual “required minimum distribution.” This ability will no longer be there.

Ryan Ellis

July 7, 2010

In just six months, the largest tax hikes in the history of America will take effect. They will hit families and small businesses in three great waves on January 1, 2011:

First Wave: Expiration of 2001 and 2003 Tax Relief

In 2001 and 2003, the GOP Congress enacted several tax cuts for investors, small business owners, and families. These will all expire on January 1, 2011:

Personal income tax rates will rise. The top income tax rate will rise from 35 to 39.6 percent (this is also the rate at which two-thirds of small business profits are taxed). The lowest rate will rise from 10 to 15 percent. All the rates in between will also rise. Itemized deductions and personal exemptions will again phase out, which has the same mathematical effect as higher marginal tax rates. The full list of marginal rate hikes is below:

- The 10% bracket rises to an expanded 15%

- The 25% bracket rises to 28%

- The 28% bracket rises to 31%

- The 33% bracket rises to 36%

- The 35% bracket rises to 39.6%

Higher taxes on marriage and family. The “marriage penalty” (narrower tax brackets for married couples) will return from the first dollar of income. The child tax credit will be cut in half from $1000 to $500 per child. The standard deduction will no longer be doubled for married couples relative to the single level. The dependent care and adoption tax credits will be cut.

The return of the Death Tax. This year, there is no death tax. For those dying on or after January 1 2011, there is a 55 percent top death tax rate on estates over $1 million. A person leaving behind two homes and a retirement account could easily pass along a death tax bill to their loved ones.

Higher tax rates on savers and investors. The capital gains tax will rise from 15 percent this year to 20 percent in 2011. The dividends tax will rise from 15 percent this year to 39.6 percent in 2011. These rates will rise another 3.8 percent in 2013.

Second Wave: Obamacare

There are over twenty new or higher taxes in Obamacare. Several will first go into effect on January 1, 2011. They include:

The Tanning Tax. This went into effect on July 1st of this year. It imposes a new, 10% excise tax on getting a tan at a tanning salon. There is no exemption for tanners making less than $250,000 per year.

The “Medicine Cabinet Tax” Thanks to Obamacare, Americans will no longer be able to use health savings account (HSA), flexible spending account (FSA), or health reimbursement (HRA) pre-tax dollars to purchase non-prescription, over-the-counter medicines (except insulin).

The HSA Withdrawal Tax Hike. This provision of Obamacare increases the additional tax on non-medical early withdrawals from an HSA from 10 to 20 percent, disadvantaging them relative to IRAs and other tax-advantaged accounts, which remain at 10 percent.

Brand Name Drug Tax. Starting next year, there will be a multi-billion dollar tax assessment imposed on name-brand drug manufacturers. This tax, like all excise taxes, will raise the price of medicine, hurting everyone.

Economic Substance Doctrine. The IRS is now empowered to disallow perfectly-legal tax deductions and maneuvers merely because it judges that the deduction or action lacks “economic substance.” This is obviously an arbitrary empowerment of IRS agents.

Employer Reporting of Health Insurance Costs on a W-2. This will start for W-2s in the 2011 tax year. While not a tax increase in itself, it makes it very easy for Congress to tax employer-provided healthcare benefits later.

Third Wave: The Alternative Minimum Tax and Employer Tax Hikes

When Americans prepare to file their tax returns in January of 2011, they’ll be in for a nasty surprise—the AMT won’t be held harmless, and many tax relief provisions will have expired. These major items include:

The AMT will ensnare over 28 million families, up from 4 million last year. According to the left-leaning Tax Policy Center, Congress’ failure to index the AMT will lead to an explosion of AMT taxpaying families—rising from 4 million last year to 28.5 million. These families will have to calculate their tax burdens twice, and pay taxes at the higher level. The AMT was created in 1969 to ensnare a handful of taxpayers.

Small business expensing will be slashed and 50% expensing will disappear. Small businesses can normally expense (rather than slowly-deduct, or “depreciate”) equipment purchases up to $250,000. This will be cut all the way down to $25,000. Larger businesses can expense half of their purchases of equipment. In January of 2011, all of it will have to be “depreciated.”

Taxes will be raised on all types of businesses. There are literally scores of tax hikes on business that will take place. The biggest is the loss of the “research and experimentation tax credit,” but there are many, many others. Combining high marginal tax rates with the loss of this tax relief will cost jobs.

Tax Benefits for Education and Teaching Reduced. The deduction for tuition and fees will not be available. Tax credits for education will be limited. Teachers will no longer be able to deduct classroom expenses. Coverdell Education Savings Accounts will be cut. Employer-provided educational assistance is curtailed. The student loan interest deduction will be disallowed for hundreds of thousands of families.

Charitable Contributions from IRAs no longer allowed. Under current law, a retired person with an IRA can contribute up to $100,000 per year directly to a charity from their IRA. This contribution also counts toward an annual “required minimum distribution.” This ability will no longer be there.

TexasBlue

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

Looky there at all them there tax increases. A sure economic recovery killer. I could almost bat an eye at this if we were humming along at a good economic pace.

TexasBlue

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

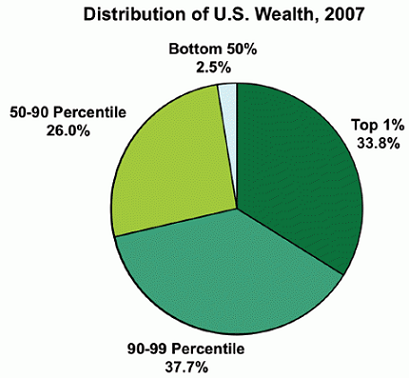

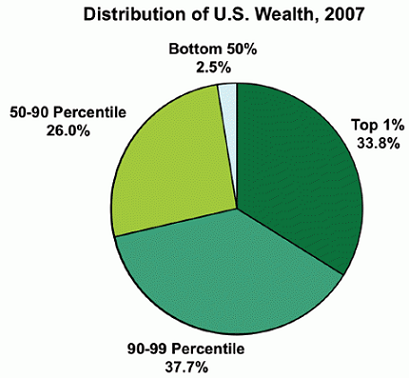

Oh my! Now the rich people who Bush enacted the tax cuts for in the first place will have to pay their fair share.

i_luv_miley

- Birthday : 1969-07-14

Age : 54

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

Here we go again with the "fair share" bit.

TexasBlue

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

You say tomayto, I say tomahto.

The point is it's not a tax increase. It's the expiration of Bush's tax cuts.

The point is it's not a tax increase. It's the expiration of Bush's tax cuts.

i_luv_miley

- Birthday : 1969-07-14

Age : 54

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

How can they pay their "fair share" when they pay an enormous amount already?

Ending the cuts makes the tax increase. Therefore, it's an increase. But hey... don't mind me. Just watch as the economy drags it's ass till the day Obummer walks out of office in 2012 when he's booted by a majority of us.

Ending the cuts makes the tax increase. Therefore, it's an increase. But hey... don't mind me. Just watch as the economy drags it's ass till the day Obummer walks out of office in 2012 when he's booted by a majority of us.

TexasBlue

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

This is one of the things we're never going to agree on. You seem to think that giving tax cuts stimulates the economy. I disagree. The "idea" might be just, but there are too many loopholes that are either ignored or abused - and never enforced (especially for the rich). The idea is borne out out of Reagan's "trickle-down economics". Except that the money never trickles down, thereby causing the rich to get richer and the poor to get poorer.

i_luv_miley

- Birthday : 1969-07-14

Age : 54

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

I really hate to have to repeat myself but i'm going to have to. I just can't keep letting this myth go unchallenged. So, as i discussed with Bubbles a few days ago, here's what i posted;

Then;

Facts, man, facts. They may have loop holes (like any taxpayer does) but that doesn't not absolve the fact that they still pay a very huge lion share of the burden in this country already. Raising them again will stifle this economy for some time to come. Mark my words. It's almost as if GW planned it this way to prove everyone wrong about tax cuts.

Total federal revenues doubled from just over $517 billion in 1980 to more than $1 trillion in 1990. In constant inflation-adjusted dollars, this was a 28 percent increase in revenue.

As a percentage of the gross domestic product (GDP), federal revenues declined only slightly from 18.9 percent in 1980 to 18 percent in 1990.

Revenues from individual income taxes climbed from just over $244 billion in 1980 to nearly $467 billion in 1990.5 In inflation-adjusted dollars, this amounts to a 25 percent increase.

Federal spending more than doubled, growing from almost $591 billion in 1980 to $1.25 trillion in 1990. In constant inflation-adjusted dollars, this was an increase of 35.8 percent.

As a percentage of GDP, federal expenditures grew slightly from 21.6 percent in 1980 to 21.8 percent in 1990.

Contrary to popular myth, while inflation-adjusted defense spending increased by 50 percent between 1980 and 1989, it was curtailed when the Cold War ended and fell by 15 percent between 1989 and 1993. However, means-tested entitlements, which do not include Social Security or Medicare, rose by over 102 percent between 1980 and 1993, and they have continued climbing ever since.

Total spending on all national security programs never equaled domestic spending, even when Social Security, Medicare, and net interest are excluded from domestic totals. In addition, national security spending fell during the Administration of the senior President Bush, while domestic spending increased in both mandatory and discretionary accounts.

This economic boom lasted 92 months without a recession, from November 1982 to July 1990, the longest period of sustained growth during peacetime and the second-longest period of sustained growth in U.S. history. The growth in the economy lasted more than twice as long as the average period of expansions since World War II.

The American economy grew by about one-third in real inflation-adjusted terms. This was the equivalent of adding the entire economy of East and West Germany or two-thirds of Japan's economy to the U.S. economy.

From 1950 to 1973, real economic growth in the U.S. economy averaged 3.6 percent per year. From 1973 to 1982, it averaged only 1.6 percent. The Reagan economic boom restored the more usual growth rate as the economy averaged 3.5 percent in real growth from the beginning of 1983 to the end of 1990.

In 1991, after the Reagan rate cuts were well in place, the top 1 percent of taxpayers in income paid 25 percent of all income taxes; the top 5 percent paid 43 percent; and the bottom 50 percent paid only 5 percent.13 To suggest that this distribution is unfair because it is too easy on upper-income groups is nothing less than absurd.

The proportion of total income taxes paid by the top 1 percent rose sharply under President Reagan, from 18 percent in 1981 to 28 percent in 1988.

Average effective income tax rates were cut even more for lower-income groups than for higher-income groups. While the average effective tax rate for the top 1 percent fell by 30 percent between 1980 and 1992, and by 35 percent for the top 20 percent of income earners, it fell by 44 percent for the second-highest quintile, 46 percent for the middle quintile, 64 percent for the second-lowest quintile, and 263 percent for the bottom quintile.

These reductions for the lowest-income groups were so large because President Reagan doubled the personal exemption, increased the standard deduction, and tripled the earned income tax credit (EITC), which provides net cash for single-parent families with children at the lowest income levels. These changes eliminated income tax liability altogether for over 4 million lower-income families.

Critics often add in the Social Security payroll tax and argue that the total federal tax burden shifted more to lower-income groups and away from upper-income groups; but President Reagan's changes were in the income tax, not in the Social Security payroll tax. The payroll tax was imposed by proponents of big government over the past 50 years, and it is they, not Ronald Reagan, who should be held accountable for its distributional effects.

Nevertheless, even if one counts the Social Security payroll tax, the share of total federal taxes increased between 1980 and 1989 for the following groups:

For the top 1 percent of taxpayers, from 12.9 percent in 1980 to 15.4 percent in 1989;

For the top 5 percent of taxpayers, from 27.3 percent in 1980 to 30.4 percent in 1989; and

For the top 20 percent of taxpayers, from 56.1 percent in 1980 to 58.6 percent in 1989.

On the other hand, the share of total federal taxes, if one includes the Social Security payroll tax, declined for four groups:

For the second-highest 20 percent of taxpayers, from 22.2 percent in 1980 to 20.8 percent in 1989;

For the middle 20 percent of taxpayers, from 13.2 percent in 1980 to 12.5 percent in 1989;

For the second-lowest 20 percent of taxpayers, from 6.9 percent in 1980 to 6.4 percent in 1989; and

For the lowest 20 percent of taxpayers, from 1.6 percent in 1980 to 1.5 percent in 1989.

Then;

Supply-Side Tax Cuts and the Truth about the Reagan Economic Record

William A. Niskanen and Stephen Moore

October 22, 1996

Bob Dole's proposal for a 15 percent income tax cut has reignited the long-standing debate about the economic impact of Reaganomics in the 1980s. This study assesses the Reagan supply-side policies by comparing the nation's economic performance in the Reagan years (1981-89) with its performance in the immediately preceding Ford-Carter years (1974-81) and in the Bush-Clinton years that followed (1989-95).

On 8 of the 10 key economic variables examined, the American economy performed better during the Reagan years than during the pre- and post-Reagan years.

* Real economic growth averaged 3.2 percent during the Reagan years versus 2.8 percent during the Ford-Carter years and 2.1 percent during the Bush-Clinton years.

* Real median family income grew by $4,000 during the Reagan period after experiencing no growth in the pre-Reagan years; it experienced a loss of almost $1,500 in the post-Reagan years.

* Interest rates, inflation, and unemployment fell faster under Reagan than they did immediately before or after his presidency.

* The only economic variable that was worse in the Reagan period than in both the pre- and post-Reagan years was the savings rate, which fell rapidly in the 1980s. The productivity rate was higher in the pre-Reagan years but much lower in the post-Reagan years.

This study also exposes 12 fables of Reaganomics, such as that the rich got richer and the poor got poorer, the Reagan tax cuts caused the deficit to explode, and Bill Clinton's economic record has been better than Reagan's.

William A. Niskanen is chairman and Stephen Moore is director of fiscal policy studies at the Cato Institute

Facts, man, facts. They may have loop holes (like any taxpayer does) but that doesn't not absolve the fact that they still pay a very huge lion share of the burden in this country already. Raising them again will stifle this economy for some time to come. Mark my words. It's almost as if GW planned it this way to prove everyone wrong about tax cuts.

TexasBlue

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

Another fact;

Historically tax cuts have always paid for themselves. Federal revenue increased after the JFK tax cuts, after the Reagan tax cuts, after the Clinton tax cuts, and after the Bush tax cuts. The problem hasn't been taxes. The problem has always been runaway spending. Total federal spending has not dropped once in over 40 years. Not once.

Under LBJ revenue grew by 25%, but spending grew by 24%.

Under Nixon revenue grew by 17%, but spending grew by 21%.

Under Ford revenue grew by 11%, but spending grew by 22%.

Under Carter revenue grew by 20%, but spending grew by 13%.

Under Reagan revenue grew by 15%, but spending grew by 25%.

Under Bush Sr. revenue grew by 17%, but spending grew by 18%.

Under Clinton revenue grew by 35%, but spending grew by 9%.

Under Bush Jr. revenue grew by 10%, but spending grew by 25%.

Historically tax cuts have always paid for themselves. Federal revenue increased after the JFK tax cuts, after the Reagan tax cuts, after the Clinton tax cuts, and after the Bush tax cuts. The problem hasn't been taxes. The problem has always been runaway spending. Total federal spending has not dropped once in over 40 years. Not once.

Under LBJ revenue grew by 25%, but spending grew by 24%.

Under Nixon revenue grew by 17%, but spending grew by 21%.

Under Ford revenue grew by 11%, but spending grew by 22%.

Under Carter revenue grew by 20%, but spending grew by 13%.

Under Reagan revenue grew by 15%, but spending grew by 25%.

Under Bush Sr. revenue grew by 17%, but spending grew by 18%.

Under Clinton revenue grew by 35%, but spending grew by 9%.

Under Bush Jr. revenue grew by 10%, but spending grew by 25%.

TexasBlue

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

We seem to agree that there is way too much being spent. But who's the money (that we don't have) being spent on? Mainly it's on those people (and businesses) that are getting the tax breaks - financial, oil, airlines, the rich who find loopholes, etc. They're the one's who are "supposed" to be "stimulating" our economy. Instead, they outsource all our jobs and then keep whatever profits for themselves and their stockholders, while at the same time not paying their fare share because of tax breaks they were given beforehand. Those very businesses meant to help the American people are the ones screwing us over by shipping the jobs to India and China, etc.

i_luv_miley

- Birthday : 1969-07-14

Age : 54

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

You can't forget the failed stimulus bill. A lot of money went to places it had no business going to.

As for business, i agree except the part of them not paying their fair share. Corporate tax is passed onto the consumer. Make it higher and we pay more. Maybe if the looters in Washington would lower the corporate tax rate, you'd see some of those jobs come back. Maybe we'd see a reduction in the price of goods.

As for business, i agree except the part of them not paying their fair share. Corporate tax is passed onto the consumer. Make it higher and we pay more. Maybe if the looters in Washington would lower the corporate tax rate, you'd see some of those jobs come back. Maybe we'd see a reduction in the price of goods.

TexasBlue

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

No way! Why would companies come back here to a place where they have to pay $7.25 an hour if they can go somewhere else where they don't even have to pay a worker that for a whole day's work?

It's not gonna happen.

BubbleBliss

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

Get real. The corporate taxes here high.

American businesses pay from 35% to 41.6% of their income in combined state and federal taxes! The 41.6% maximum rate is scheduled to rise to 46.2% in 2010 when Obama's promised tax increases are implemented.

American businesses pay from 35% to 41.6% of their income in combined state and federal taxes! The 41.6% maximum rate is scheduled to rise to 46.2% in 2010 when Obama's promised tax increases are implemented.

TexasBlue

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

How else would you suggest your enormous deficit ought to be cut? We are facing the same problems here and at the moment, most people aren't grumbling too much about public service cuts and tax increases because they are being realistic.

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

I totally agree that the stimulus was mishandled. There was no accountability for where the money went! And that's really at the crux of my point - greed. When money is involved, there should always be accountability. But at the same time, I do agree with the bailout. Our economy was already in the tank (caused by years of mismanagement, lack of oversight, greed, etc) and something drastic had to be done. But no, Obama's handling of the bailout wasn't an improvement over what Bush had been allowed to do. But the bailout itself probably saved our economy from completely collapsing... So when I hear the "right" calling Obama a socialist, I just have to laugh (and scream). The man is big business all the way - just like Bush, Clinton, Bush, Reagan were. IMO, the de-regulations during the Reagan years are what began the process of the economic collapse that we see today. And the outsourcing of all our jobs during the Dubya years only made things worse.TexasBlue wrote:You can't forget the failed stimulus bill. A lot of money went to places it had no business going to.

As for business, i agree except the part of them not paying their fair share. Corporate tax is passed onto the consumer. Make it higher and we pay more. Maybe if the looters in Washington would lower the corporate tax rate, you'd see some of those jobs come back. Maybe we'd see a reduction in the price of goods.

i_luv_miley

- Birthday : 1969-07-14

Age : 54

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

TexasBlue wrote:Get real. The corporate taxes here high.

American businesses pay from 35% to 41.6% of their income in combined state and federal taxes! The 41.6% maximum rate is scheduled to rise to 46.2% in 2010 when Obama's promised tax increases are implemented.

That may have been the reason they left, but think about it.

Why would they pay John Miller $8 an hour if they could pay Jose Sanchez $3 a day? That's a HUGE profit gain, especially with NAFTA. But even without NAFTA the import costs, transportation costs, relocation costs, etc. are NOTHING compared to the millions of dollars they'd save in salaries ever year. Not to mention the fact that in developing countries, there are no safety regulations and other such things.

Outsourcing is going to happen no matter what.

BubbleBliss

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

The_Amber_Spyglass wrote:How else would you suggest your enormous deficit ought to be cut? We are facing the same problems here and at the moment, most people aren't grumbling too much about public service cuts and tax increases because they are being realistic.

Spending. If they raise taxes on corporations, we as citizens get stuck with higher prices. They need to trim gov't fat big time. There's so much waste in this gov't that it's astounding. I'm not talking cutting public service stuff or social services.

I'm going to have to find examples of gov't waste so you can shake your head along with me.

TexasBlue

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

i_luv_miley wrote:I totally agree that the stimulus was mishandled. There was no accountability for where the money went! And that's really at the crux of my point - greed. When money is involved, there should always be accountability. But at the same time, I do agree with the bailout. Our economy was already in the tank (caused by years of mismanagement, lack of oversight, greed, etc) and something drastic had to be done. But no, Obama's handling of the bailout wasn't an improvement over what Bush had been allowed to do. But the bailout itself probably saved our economy from completely collapsing... So when I hear the "right" calling Obama a socialist, I just have to laugh (and scream). The man is big business all the way - just like Bush, Clinton, Bush, Reagan were. IMO, the de-regulations during the Reagan years are what began the process of the economic collapse that we see today. And the outsourcing of all our jobs during the Dubya years only made things worse.

Agreement on most of that. But outsourcing isn't stopping under this administration. There's nothing they can do about it unless they lower the corporate tax rate.... or make a law... neither of which they have done. Both parties are to blame for this. Greed goes towards the Dems as well.

Bama isn't pro-business. There's plenty out there to refute that. He's probably more pro now than he was before becoming prez, but he still isn't pro biz like the GOP is.

TexasBlue

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

BubbleBliss wrote:That may have been the reason they left, but think about it.

Why would they pay John Miller $8 an hour if they could pay Jose Sanchez $3 a day? That's a HUGE profit gain, especially with NAFTA. But even without NAFTA the import costs, transportation costs, relocation costs, etc. are NOTHING compared to the millions of dollars they'd save in salaries ever year. Not to mention the fact that in developing countries, there are no safety regulations and other such things.

Outsourcing is going to happen no matter what.

If they didn't have a high corporate tax rate, they could pay people more because it wouldn't cut into profits. Their tax rate goes down, the price of goods goes down. They'd have to pay more because people would know that they were pocketing even more. In case you're not aware, corporations have to post their earnings every quarter. Everyone knows hat they're making.

TexasBlue

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

That would be the first time ever that corporations get tax deductions and pay their workers more. Tons of corporations end up paying 0% taxes because of loop holes and other things and you don't see the worker benefiting from that.

Paying somebody $3 a day will skyrocket your stocks, therefore making the stockholders very happy. No modern country can compete with that until every country in the world is up to modern standards. In the modern world, manual labor is only kept in countries if it is impossible to relocate it to other countries. Slaughterhouses and meatpacking factories, for example, can't be outsourced because of transportation costs and time.

Also, certain goods that are manufactured need close oversight because of quality, engineering, etc. and that's why they haven't moved offshore because they don't have those kind of "specialists" in Cambodia or Bangladesh and not many Quality Engineers would want to live there.

BubbleBliss

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

Yeesh. The burden of corporate tax is ultimately shouldered by customers (through higher prices), stockholders (smaller dividends and capital gains), and employees (lower wages). What part of this do you not get???? I feel like i'm replying to a different person every time we discuss this. It's Economics 101, fer crissakes!

For your enjoyment;

http://www.reuters.com/article/idUSN1249465620080812

For your enjoyment;

http://www.reuters.com/article/idUSN1249465620080812

TexasBlue

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

So what? What you've been telling me has nothing to do with the subject at hand. I said that corporations would never move manufacturing back to the US because they'll always get a better deal offshore and now you're telling me about who benefits from corporate tax, even though it has nothing to do with it.

BubbleBliss

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

BubbleBliss wrote:So what? What you've been telling me has nothing to do with the subject at hand. I said that corporations would never move manufacturing back to the US because they'll always get a better deal offshore and now you're telling me about who benefits from corporate tax, even though it has nothing to do with it.

Selective reading again. I've said time and again that they would move back here if the corporate tax rate wasn't as high as it is.

Sometime i think you do this specifically to get a rise out of me.

TexasBlue

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

And I've told you that they make a much bigger profit abroad, so why would they move back?

Go back and read the debate so far!

BubbleBliss

Re: Six Months to Go Until The Largest Tax Hikes in History

Re: Six Months to Go Until The Largest Tax Hikes in History

I agree completely. And I will add, why would the companies come back to America when they could keep them in India (for example) and not have to pay those workers anywhere near what the American worker would get? It's because the companies want to pocket the profits (that they are guaranteed to make) for themselves... Yes, the companies that outsource do stimulate the economy - the economies of other countries!BubbleBliss wrote:

And I've told you that they make a much bigger profit abroad, so why would they move back?

i_luv_miley

- Birthday : 1969-07-14

Age : 54

Page 1 of 2 • 1, 2

Permissions in this forum:

You cannot reply to topics in this forum